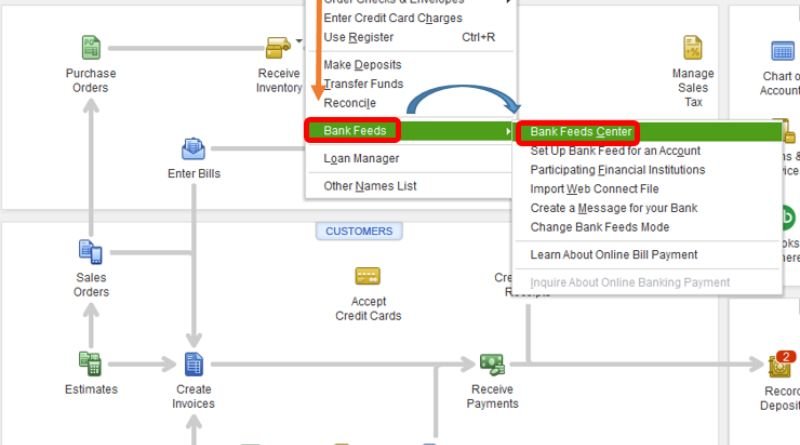

3 Easy Steps to Enter Credit Card Charges in QuickBooks Desktop

While QuickBooks Desktop makes it easy to enter and record your credit card charges, you’ll have to take an extra step if you want to use them as expenses, especially when you bill customers. This guide will show you the three steps you need to follow to enter your credit card charges in QuickBooks so that they can be used as expenses later on.

Click Transaction > Create New > Payments

Entering a credit card charge is easy when you know where to look. Follow these three steps:

- Search for the credit card payment type by clicking Transactions > Create New > Payments

- Fill out the fields that pop up and specify the payment’s Account (e.g., Checking) and Type (e.g., Credit Card Payment)

- Choose an appropriate Expense Category and enter your estimate amount of what you owe

Name the transaction

- Open QuickBooks Desktop and go to the Vendors tab and click on Add a New Vendor.

- Fill out the Name, Address, Tax ID Number and Phone Number fields. Click on OK. On the left side of your screen you will see a list of all your current vendors with their names and addresses as well as what type of vendor they are.

- Find your credit card company in this list then right-click it to open its menu options: enter transactions, enter credit card charges, etc.

- Click on Enter Transactions or Enter Credit Card Charges (depending on which you need).

Select Recipient Account

- To open the Chart of Accounts window, click on View > Chart of Accounts. 2. From the list of account types, select: Miscellaneous Income.

- When prompted for the name of the account you’re adding, enter Credit Cards.

For businesses that are just starting out, it can be hard to keep track of multiple projects, not to mention finances, client information, and more. Fortunately, there are programs like Daylite that can make your life much easier by centralizing all the information you need in one place, saving you time and improving your ability to run a profitable business. But Daylite isn’t the only solution available on the market; here’s an overview of what this program has to offer—and why it may not be the best fit for your business.